These payment services work in basically the same way. You can save your debit or credit cards, and use them while paying, so you don’t need to carry your cards & cash everywhere. Using the online payment mode saves your time, as you can complete transactions in a few taps. Since there are so many digital wallet services around you, how do you decide which online payment service to choose? This article is a comparison between Google Pay & Samsung Pay. After reading this, you will learn about their features and working, and decide for yourself. Also, Read: How To Start Investing In Bitcoin As A Beginner

Google Pay

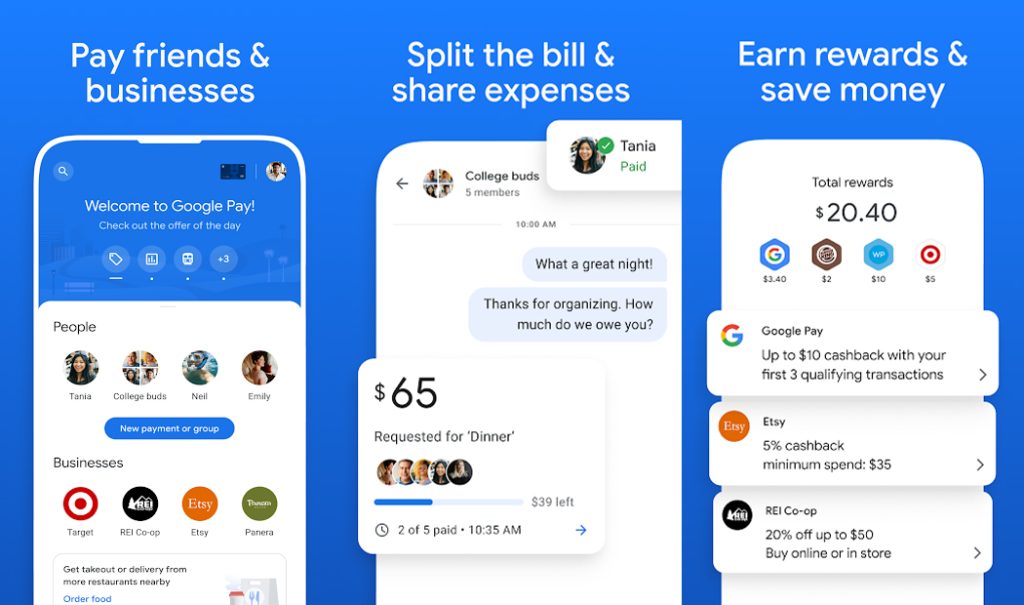

Google Play was released initially in 2011 with the name Google Wallet, which changed into Android pay in 2015 and later to Google Pay in 2018. It has 7.1 million downloads on the play store currently. Its interface is easy to use and understand. Features

Google Pay uses Nearfield Communication (NFC) technology, which transfers the card details to the card reader to make payments.

They offer gift vouchers, cashbacks, referral offers, and many more benefits to their users.

It’s available for Android & iOS, making it more accessible since Samsung Pay only works for Samsung smartphones. Google Pay is functional on smartwatches like Samsung Galaxy 4, Fossil’s Men Gen 5E, Ticwatch Pro 3 GPS, etc.

You can recharge your phones, pay bills, and perform transactions quickly. Per-day transactions have a limit on them depending on your bank.

Samsung Pay

Samsung Pay was initially launched in their home country, South Korea, in 2015 and later in the United States in 2016. You must have a Samsung device for using Samsung Pay digital wallet, which is considered a drawback since this restricts access to the service. Features

The most appealing thing about Samsung Pay is the swipe gesture payment feature. This feature allows you to make payment with just a swipe gesture and from the home screen itself. With their swift UI, you can easily change cards smoothly while making payments.

You can operate Samsung Pay through smartwatches like Gear Sport, Galaxy Watch Active 2, Gear S2, Gear S3, and Galaxy Watch, making it easy to use. These contactless payments are made possible by Nearfield Communication (NFC) Technology.

Samsung also uses Magnetic Secure Transmission (MST) Technology but, they halted this technology in the S21 Series. We will talk about these technologies later.

Notifications can get a bit annoying while using Samsung Pay, so you get the option to customize notifications regarding deals and offers.

Google Pay vs Samsung Pay – The Comparison

Accessibility

For non-Samsung users, unquestionably, Google Pay is the better option. It is more widely used, even internationally Google pay is available in more countries than Samsung Pay. You can even use Google Pay for transportation-related payments in the United States & many parts of Europe. In many places, vendors have installed QR codes. You can scan these codes using Google Pay and make quick payments to the vendor. Samsung Pay can function using MST in countries with no NFC technology. But, the fact that Samsung Pay works only in 23 countries makes this feature less impactful.

Security

Google Pay and Samsung Pay do not store your data while performing a transaction, which ensures the security of your bank and card details. Additionally, Samsung proclaims using the Knox system, considered the most secure mobile system. Both the services use a facial recognition system, fingerprint scanner, and a few other security features to safeguard your details. Google Pay & Samsung Pay create and use a virtual number during payments instead of your cards to ensure safer transactions.

Efficiency

When it comes to paying at the store, Samsung Pay comes at the top because of the contactless swipe gesture feature. This feature is more instantaneous, and it becomes essential as it helps maintain social distancing in these difficult times of the Corona Virus pandemic.

Inclusion of Banks

Google Pay includes more banks on their application and gets regular updates via developers. Google Pay and Samsung Pay will not work where you need to insert your card.

Benefits

You can use Google Pay for holding boarding passes, loyalty cards, vouchers & coupons. In Samsung Pay, you can store loyalty cards, debit & credit cards. Google Pay rewards with coupons, vouchers, and cashback for making payments, whereas Samsung Pay gives points for every transaction, just like you get on credit or debit cards. You can use these for getting offers or gift cards, most of which are for Samsung gadgets.

Compatibility

In terms of compatibility, we have a clear picture to compare. On the one hand, where Samsung Pay is only supported on the high-end Samsung smartphones; Whereas Google Pay on the other hand is supported on most Android as well as iOS devices, the only requirement is that the smartphone should have NFC support.

What is Nearfield Communication Technology?

This technology is generally used for processing transactions securely, transferring data, etc. Just bring the devices in the range (less than 4 inches) for completing the transaction. With the rise of digital transactions, NFC makes it easier to make payments. Whenever the device comes in contact with the reader, your payment app will ask for confirmation regarding the transaction. All these processes are safe and secure.

What is Magnetic Secure Transmission?

Magnetic Secure Transmission induces magnetic signals, like usual debit/credit cards. These magnetic signals get transmitted to the card reader. Using this technology, you don’t have to carry your cards everywhere, and transactions are processed quickly and safely.

Google Pay Vs Samsung Pay – Conclusion

It all comes down to whether or not you want to buy a Samsung smartphone since Samsung Pay works only on your own devices. Google Pay certainly comes at the top if you don’t own a Samsung gadget. It works on both iOS & Android. Although Samsung Pay has a plus point of having MST technology, MST is exclusively available in a few countries. If you own a Samsung device, you should try both of them and then formulate your own opinion. Also, Read: Samsung Pay Rewards: All you need to know